- +91 9898742010

-

Retirement is when you stop living at work and start working at living. Some also says; When a man retires, his wife gets twice the husband but only half the income.

Do you know your number? Do you know how much capital you need when you reach retirement to sustain your standard of living for the rest of your life?

Do you know how much you have to save to reach your number?

Do you have a plan and process that can provide an optimum return and withstand the emotional roller coaster investors constantly experience?

Factors to Be Considered While Planning for Retirement Fund

Most of us will not be able to retire on time.

90% of us fail to build sufficient retirement fund by the age of 60 years.

About 50% may not be employed after 45 years of age leading to forced retirement.

It is important that you have enough funds to support yourself when you grow older, rather than depend on your children or other sources for financial support. We help you plan meticulously for your retirement fund, so that you can build your retirement corpus starting now, and so that your retired years could be stress free.

90% of us fail to build sufficient retirement fund by the age of 60 years.

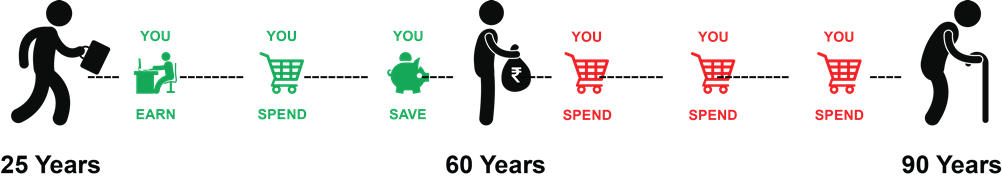

Longevity Risk is a risk we will all have to learn to live with and plan for. It is very important start early as far as planning for Retirement Capital is concerned as you can reap the benefits of Long Term Compounding.

With people living longer till 85-90 years, the conversations and concerns around retirement have grown. One might think that they will not live too long. But what if you live a lot longer than what you thought? Who will pay for you?

Once you retire, you enter a new stage of life where opportunities are vast and exciting. It's time when you do what you want to, rather than what you have to.

So define what will give you meaning in the next stage of life? It's you who has to decide what would be the next chapter of life called

Some of the Common Mistakes people make in Retirement Planning:

+91 9898742010

Fine Investments

1015 Dev Atelier 100 Ft. Anandnagar Rd.

Prahladnagar Ahmedabad 380015

Copyright © FineInvestments 2020. All rights reserved.